what percentage of taxes are taken out of my paycheck in ohio

So the tax year 2022 will start from July 01 2021 to June 30 2022. The state of Ohio requires you to pay taxes if youre a resident or nonresident that receives income from an Ohio source.

Ohio Tax Law Now Lines Up With Federal Law Ohio Cpa Firm

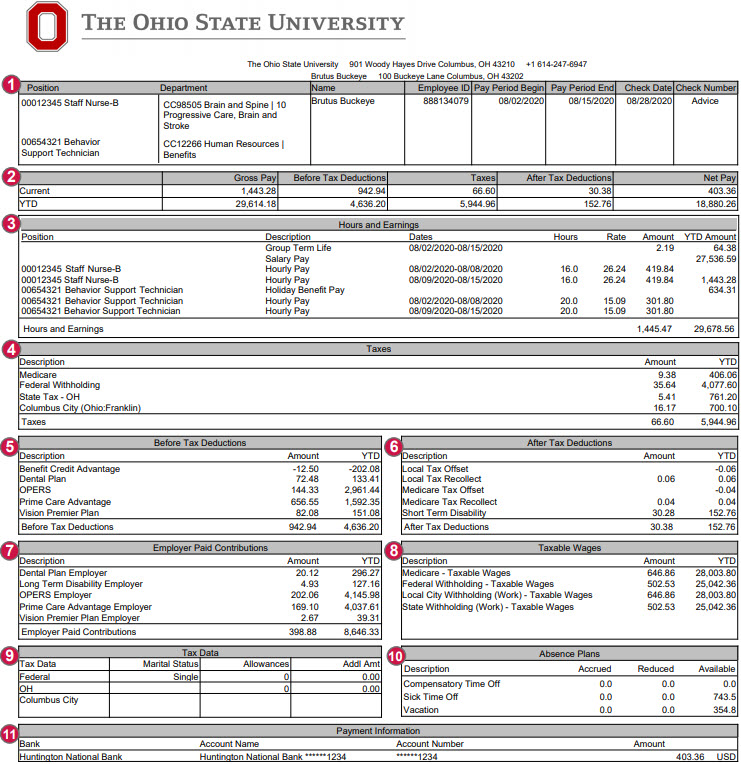

FICA taxes consist of Social Security and Medicare taxes.

. 10 12 22 24 32 35 and 37. Ohio Hourly Paycheck Calculator. FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings for a.

Whats the tax rate on a paycheck in Ohio. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Total income taxes paid.

What is the percentage that is taken out of a paycheck. Alone that would place Ohio at the lower end of states with an income tax but many Ohio municipalities also charge income taxes some as high as 3. Some states follow the federal tax.

The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Once the Federal government has taken its share state and local tax authorities also take a piece of an employee paycheck.

10 percent 12 percent 22 percent 24 percent 32. FICA stands for Federal Insurance Contributions Act and is a US. You pay the tax on only the first 147000 of.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. What is the percentage of federal taxes taken out of a paycheck 2020. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly.

The 2021 state income tax rates range from 2765 to 399. If no tax is being withheld please provide us with the facts in writing and include a copy of your most recent W-2 or paystub and submit this to the Ohio Department of Taxation Employer. The federal withholding tax.

Ohio State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state SUI in full and on time you get a 90 tax credit on. However they dont include all taxes related to payroll. The federal income tax has seven tax rates for 2020.

What percentage of my paycheck is withheld for federal tax 2021. Amount taken out of an average biweekly paycheck. Tax rates vary from state to state with 43 states.

The state tax year is also 12 months but it differs from state to state. Total income taxes paid. Calculating your Ohio state income tax is similar to the steps we listed on our Federal paycheck calculator.

FICA taxes are commonly called the payroll tax. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The federal withholding tax has seven rates for 2021.

The bonus tax calculator is.

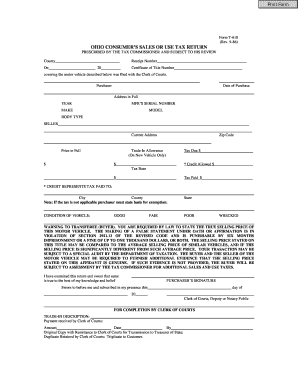

1099 Form Ohio Printable Fill Out And Sign Printable Pdf Template Signnow

Final Paycheck Laws In Ohio Legal Guide 2021 Lawrina

New Tax Law Take Home Pay Calculator For 75 000 Salary

My First Job Or Part Time Work Department Of Taxation

Explaining Ohio S Maze Of City Income Tax Rates And Credits And Why You Should Log Where You Ve Been Working That S Rich Cleveland Com

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Ohio Paycheck Calculator Smartasset

What Is Local Income Tax Types States With Local Income Tax More

Federal Tax 40k Salary Example Us Tax Calculator 2022

Ohio Estate Tax Everything You Need To Know Smartasset

School District Income Tax Department Of Taxation

Frequently Asked Questions Office Of Business And Finance

State W 4 Form Detailed Withholding Forms By State Chart

Tax Ohio Fill Out Sign Online Dochub

Visualizing Taxes Deducted From Your Paycheck In Every State

Ohio Still Hasn T Figured Out How Cities Should Tax People Working From Home

Ohio Income Tax Calculator Smartasset

Cities Brace For Tax Refund Requests From Employees Working At Home